Page 129 - kpi21190

P. 129

129

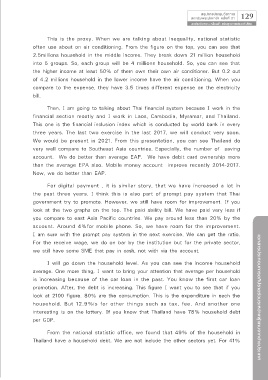

This is the proxy. When we are talking about inequality, national statistic

often use about on air conditioning. From the figure on the top, you can see that

2.5millions household in the middle income. They break down 21 million household

into 5 groups. So, each group will be 4 millions household. So, you can see that

the higher income at least 50% of them own their own air conditioner. But 0.2 out

of 4.2 millions household in the lower income have the air conditioning. When you

compare to the expense, they have 3.5 times different expense on the electricity

bill.

Then, I am going to talking about Thai financial system because I work in the

financial section mostly and I work in Laos, Cambodia, Myramar, and Thailand.

This one is the financial inclusion index which is conducted by world bank in every

three years. The last two exercise in the last 2017, we will conduct very soon.

We would be present in 2021. From this presentation, you can see Thailand do

very well compare to Southeast Asia countries. Especially, the number of saving

account. We do better than average EAP. We have debit card ownership more

than the average EPA also. Mobile money account improve recently 2014-2017.

Now, we do better than EAP.

For digital payment , it is similar story, that we have increased a lot in

the past three years. I think this is also part of prompt pay system that Thai

government try to promote. However, we still have room for improvement. If you

look at the two graphs on the top. The paid ability bill. We have paid very less if

you compare to east Asia Pacific countries. We pay around less than 20% by the

account. Around 4%for mobile phone. So, we have room for the improvement.

I am sure with the prompt pay system in the next exercise. We can get the ratio.

For the receive wage, we do on bar by the institution but for the private sector,

we still have some SME that pay in cash, not with via the account.

I will go down the household level. As you can see the income household

average. One more thing, I want to bring your attention that average per household

is increasing because of the car loan in the past. You know the first car loan

promotion. After, the debt is increasing. This figure I want you to see that if you

look at 2100 figure. 80% are the consumption. This is the expenditure in each the เอกสารประกอบการอภิปรายร่วมระหว่างผู้แทนจากต่างประเทศ

household. But 12.9%is for other things such as tax, fee. And another one

interesting is on the lottery. If you know that Thailand have 78% household debt

per GDP.

From the national statistic office, we found that 49% of the household in

Thailand have a household debt. We are not include the other sectors yet. For 41%